By Julia K. Pham, CFP®, AIF®, CDFA®, Wealth Advisor at Halbert Hargrove

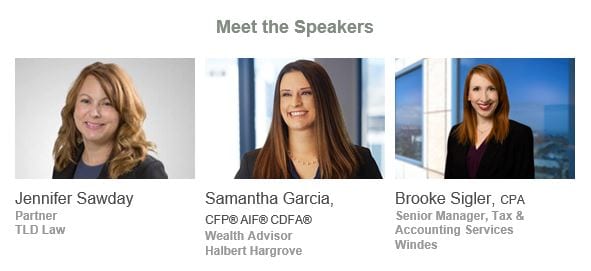

Halbert Hargrove held a virtual discussion with Brooke Sigler, a senior manager and CPA at Windes, Jennifer Sawday, a partner at TLD Law, and our very own wealth advisor, Samantha Garcia, to talk about the most common financial mistakes they see. They also discussed smart money habits worth cultivating during uncertain times. I came away thinking that this content would be useful to share with clients right now, especially since many of these ideas can be quickly implemented and the mistakes easily avoided.

With the fall and winter left to go, 2020 has already been quite the year. Between a global pandemic, record unemployment rates, civil unrest, and homeschooling children while also working from home, this year has left even the calmest person feeling anxious and wondering, “what could possibly be next?” With the future feeling very uncertain, one of the things you can do to help calm those nerves is working on what you can control. Having an emergency fund, paying down high-interest debt and saving for retirement are all solid practices to implement. My colleagues have been discussing many of these in blogs posted to this site.

But what are some common pitfalls to avoid in your financial lives? What follows are some of the most common mistakes experts see, and how to overcome them to make the road ahead a little less uncertain.

Thinking you can do it all

The first thing to remember is that you are not alone – and if you feel like you are, you don’t have to be. A common mistake that Samantha notices in her practice? Investors who don’t seek professional help. Finances can get complicated and investing can become quite emotional. She sees many DIYers looking to save some money by managing their portfolios themselves. Given the long bull run we saw up until March, some people began to get overconfident in their abilities. This can lead to mistakes. Timing the market and not having a fully diversified portfolio are a couple of the most common wrong moves. In the short run, DIYers may save some money. But especially during this last correction, they may have suffered losses that will have an impact far into the future.

When I’m asked about how to choose the right advisor, here’s my typical response: Seek out an advisor who can help you make investing a less emotional process for yourself. There are many investment approaches and ways of working to choose from to fit your needs. Getting recommendations from friends or family, or using a service like Zoe Financial is a good place to start. Just make sure that whomever you choose is a fiduciary and has an ethical and legal duty to put your interests first.

Forgetting to involve your advisors

Maybe you’ve done the legwork and interviewed and hired your team of professionals. Don’t make the common mistake that Brooke Sigler sees her clients do, which is not involving her before they make a major life decision. Many clients talk to their CPAs once, maybe twice a year – typically around tax time. Taxes are very cyclical, so many forget that your CPAs are there year-round, and helpful to consult before any large transaction that may have a financial impact.

Sigler experienced one client who learned the hard way when helping her daughter purchase a house. The client mistakenly took $200,000 out of her IRA to help with the down payment. What the client didn’t realize – until it was too late – was that she would have to pay ordinary income taxes on the amount of the distribution. This was the painful surprise that she was faced with the following April. To make matters worse, the client then had to take out another distribution from the IRA just to pay for the taxes! With a little advice from her CPA, she could have evaluated other funding sources, including taking distributions over time to spread out the tax impact, or taking a smaller lump sum and helping with her daughter’s loan payments over time.

Stopping before you’ve crossed the finish line

When it comes to getting an estate plan done, the biggest hurdle is finding the right attorney and making the appointment. If you’ve gotten that far, and your attorney has drafted your documents, you are getting close to completion, but not quite! A common mistake Jennifer Sawday sees in her practice is for clients to receive their estate planning documents, but not follow through with signing them and getting them notarized. So don’t forget, your John Hancock is an important factor in making those documents legally binding. Not only that, but you’ll save yourself a big headache if the day comes when you need them and find out they’re not legally actionable because they aren’t signed.

Another common mistake Sawday sees is that clients set up their trust but don’t fund it. Your trust is meaningless if you don’t go back and retitle your financial accounts to match the name of the trust. So, pick up the phone and call your financial advisor or bank to make sure this important step is done. If you’re dealing with retirement accounts, those will be titled individually, but you’ll need to establish the beneficiaries of these accounts for estate purposes.

The bottom line

Life is full of financial pitfalls – understandably so given how uncertain things can be. Luckily, help is available for navigating the road ahead. All of us have plates that are pretty darn full right now with the current environment. Fortunately, many of the financial and legal pitfalls I’ve discussed here can be avoided by communicating with your advisors, along with solid planning and follow through.

How do you balance having the life you want to enjoy today with what you’re going to need in the future? Are you doing what it takes to enter your dream retirement? TAKE OUR QUIZ to find out.