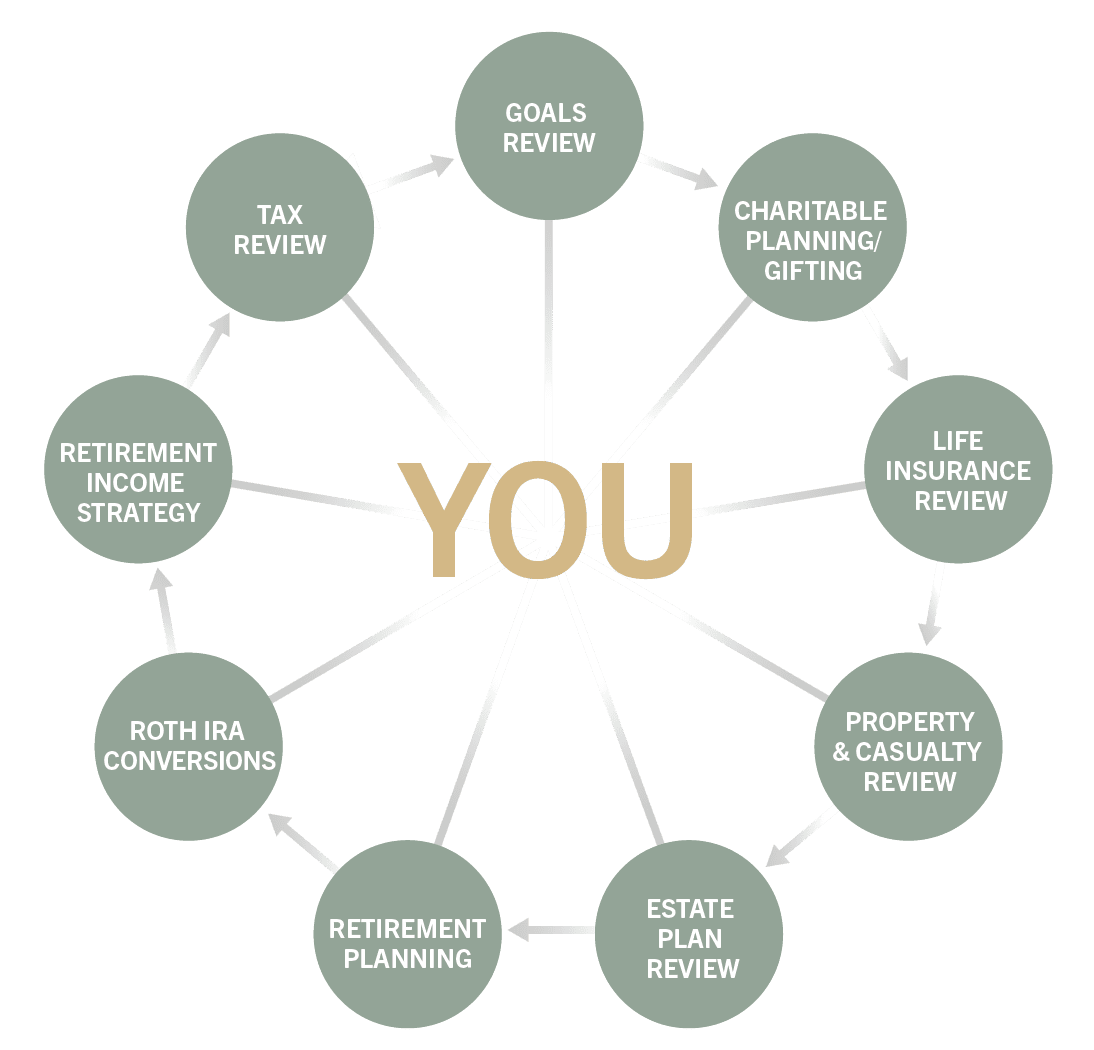

HH’s planning process integrates your interests and needs, adapting to your life choices over time.

your entire financial picture

Funding Your Lifestyle

Today And Tomorrow

Managing assets and cash flow, along with current and future expenses

Protecting

Your Assets

Employing strategies for risk protection—including safeguarding your earning potential

Identifying Tax

Considerations

Strategizing on best-case positioning for your portfolio and income sources

Addressing Estate And

Legacy Matters

Funding your family’s future as well as your philanthropic aspirations

Providing For All

Commitments

Ensuring all your financial promises and responsibilities are sustainable

Reviewing Your Plan

Frequently

Updating as circumstances change; planning is dynamic and collaborative

Goals driven. Not returns driven.

There’s more to a well-lived life than money and resources. HH’s LifePhase Investing® is about building portfolios that will help you reach your goals for every stage of the journey, while addressing concerns about increasing longevity.

Learn about LifePhase Investing®

Discover LifePhase Investing®

A new model of financial planning tailored to your life goals

Build & Grow

This financial phase aligns with your peak earning years, where you gather assets and save. Earning potential, saving discipline, and insurance are crucial.

Transition

The transition phase focuses on strategy execution to shift from earning to reaping rewards. Here, savings and strategizing are impactful as you look toward transitioning to retirement.

Distribute & Deploy

This phase starts when you withdraw from retirement accounts and focus on legacy planning. Strategic investing and withdrawal planning are key to helping your goals progress on stable financial ground.