by Stephen W. Bedikian, Associate Wealth Advisor at Halbert Hargrove

How to Navigate California’s Taxes

If there’s a contest you don’t want to win, it’s the contest to pay the highest state taxes in the country. If you live in California, unfortunately you win – you face the highest income tax rates of any state in the U.S., with the marginal tax rate maxing out at 12.3%. This feels particularly egregious when residents in neighboring state Arizona pay just 2.5%. In Nevada there’s no income tax at all.

And of course, income tax is just the beginning: When you need to spend your after-tax income on living expenses, there are lots of other kinds of taxes to pay, like property tax, sales tax, and taxes on gas. While California residents are often stoic about accepting taxes as just one of the tradeoffs we make for living here, paying attention to the painfully long list of taxes can allow you to aim to optimize your income and expenses.

For example, when you’re contributing to your 401k plan at work, that contribution is more valuable than in other states because you’re avoiding California’s higher state income tax on that contribution amount. Ultimately you will have to pay state income tax (and federal tax) on your contribution, but not until you withdraw it. Potentially, this will occur when you’re in a lower tax bracket, so why not max out that retirement contribution now?

Read on for an overview of the types of taxes in California.

Income Tax

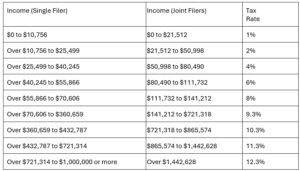

Not all Californians pay the maximum state tax rate of 12.3%. The schedule is graduated and you won’t hit that tax bracket until you make over $1 million annually. The rate paid in each bracket increases marginally upward. Your effective tax rate will always be lower than the marginal tax rate because a higher rate is applied to each portion of your income that falls into each bracket. If you’re single and make $100,000, you pay 1% on the first $10,756, then 2% on the next $14,743 (up to $25,499) and so on.

California Income Tax Brackets (2024)

Source: California Franchise Tax Board (CFTB)

Think about how NBA star Luca Doncic must have felt when he heard he was being traded from the Dallas Mavericks (no state income tax in Texas) to the Los Angeles Lakers (highest state income tax). His $43 million salary lands him firmly in the state’s highest bracket.

The state of California also taxes capital gains as ordinary income so those gains are added to your salary when your total taxes are calculated.

Here’s a link to a California income tax calculator: California income tax estimator.

California Property Taxes

If Luca decides to buy a house in his new home city of Los Angeles, he will have to pay property taxes. California’s Proposition 13 limits the California property tax rate to 1 percent of the property’s full cash value plus the rate necessary to fund local voter-approved bonded indebtedness. Property assessments are only done when there is a change of ownership or after new construction. The amount can increase no more than 2% annually.

If you’ve owned a house for a long time in California, you’re probably paying very low property taxes based on how long ago you purchased your home. Unfortunately for new home buyers, that property tax will be based on today’s highly inflated market prices. If Luca buys an expensive home in Los Angeles, he can also look forward to paying the ‘mansion tax’. Sellers pay a 4% tax on home sales over $5.15 million and 5.5% on home sales over $10.3 million.

California Sales Tax

When California residents use their after-tax income for their daily expenses, they can expect to pay sales tax. The state sales tax is 7.25%; localities can then add their own sales tax on top of that. In Los Angeles, that’s an additional 3%, for a total sales tax of 10.25%. Across the state, the average sales tax is 8.85%, which is “only” the 8th-highest state sales tax rate in the country.

You’ll pay that sales tax on most items, with the exception of groceries and prescription medications. Sadly, alcohol is not exempt from sales tax – so if the Lakers win the NBA Championship with their new star player, they will be paying $270 for each bottle of Dom Perignon champagne plus another $27.68 per bottle in sales tax for their celebration.

California Excise Taxes

Let’s not forget the tax that most California residents get to pay each week when they refill their gas tanks. California has a sales and use tax of 2.25%, plus an excise tax of $0.596 per gallon. That amounts to 69.8 cents a gallon – and that’s before the federal government piles on. And yes, we win that contest too for highest state gas taxes in the country. Illinois comes in a close second at 67.1 cents per gallon. Nice try.

Luca owns several serious gas-guzzling autos, including a Lamborghini Urus, a Ferrari 812 Superfast and a Porsche 911 Turbo S. It might be time to consider going electric.

California Estate Taxes

Unlike 12 states and the District of Columbia, there is actually no state estate tax in California. So, if you stay in California long enough, your estate won’t see an estate tax levied by California.

So, let’s all give a big thank you to Luca. We appreciate all the taxes (except estate tax) you’re going to pay here in the Golden State and welcome to the club!

Disclaimer:

Halbert Hargrove Global Advisors, LLC (“HH”) is an SEC registered investment adviser located in Long Beach, California. Registration does not imply a certain level of skill or training. Additional information about HH, including our registration status, fees, and services can be found at www.halberthargrove.com.(opens in a new tab) This blog is provided for informational purposes only and should not be construed as personalized investment advice. It should not be construed as a solicitation to offer personal securities transactions or provide personalized investment advice. The information provided does not constitute any legal, tax or accounting advice. We recommend that you seek the advice of a qualified attorney and accountant. All opinions or views reflect the judgment of the author as of the publication date and are subject to change without notice. All information presented herein is considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted.