By Tony Delane, CFP®, AIF®, Wealth Advisor

The groundbreaking, tax-trimming Tax Cuts and Jobs Act (TCJA), which rolled out back in 2018, is set to sunset at the end of 2025. If federal legislators don’t make changes to extend the window of this legislation or immortalize its provisions, it’s time to start preparing for the impact of increased federal income and estate taxes.

But first, some background on the Act. On September 27, 2017, the New York Times described the newly announced TCJA as the Most Sweeping Tax Overhaul In Decades. Here at HH, we were truly all hands-on deck as our team discussed and planned for changes with our clients and their broader professional networks of CPAs and estate planning attorneys. By January 1, 2018, most of the changes went into effect, with many of them scheduled to only last through the end of 2025.

This Act really changed the way we approached tax and estate planning. At the time, 2025 felt like a lifetime away. Now we’re now only a few months away. Many of the TCJA’s provisions for taxpayers are set to sunset at the end of next year.

Here are several of our top concerns as the Tax Cuts and Jobs Act’s rates are set to expire. Please keep in mind that this is not an exhaustive list of the impact of the sunset; we recommend you speak with your tax or legal professional for full details on how you may be impacted.

Tax Rates to Individual Tax Brackets

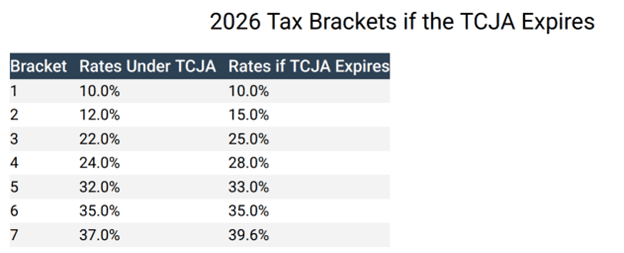

The TCJA kept the traditional seven income brackets, but made a number of changes to individual tax brackets, lowering rates for five of them. While actual income thresholds change from year to year, the TCJA sunset will change the rates within each bracket. Here is a chart showing what the difference may look like:

Source: https://taxfoundation.org/blog/2026-tax-brackets-tax-cuts-and-jobs-act-expires/

Itemized Deductions Will Need to Be Closely Tracked

While the TCJA broadly changed how families managed and reported their income taxes, their deductions were perhaps affected the most. For example, the standard deduction was almost doubled. This simplified filing for a lot of people. In 2020, only 9% of taxpayers claimed itemized deductions on their federal return. This is a sharp change from the pre-Act 2017 tax year, where 31% of all individual tax returns had itemized deductions.

If the TCJA sunsets as expected, more taxpayers will need to be prepared to once again closely track their eligible deductions and report them to their tax preparer. Many pre-TCJA deductions would be back on the table unless legislators step in. This includes the SALT (State And Local Tax) deduction, currently capped at $10,000. Other deduction ceilings due to sunset include mortgage interest, charitable contributions, and medical expenses; a TCJA expiration would unlock various other deductions like professional advisory fees.

Sources: https://www.irs.gov/statistics/soi-tax-stats-tax-stats-at-a-glance

Lifetime Exclusion / Estate Tax Reduced

In addition to the potential impact on your income taxes in the event of a TCJA expiration, the potential impact on estate taxes could be significant. One provision of the TCJA almost doubled the Federal Estate Tax Exemption. This is a number that gets adjusted annually, and the 2025 exemption amount is $13,990,000 per person – for married couples, that number is $27.98 million. In other words, for those who pass away in 2025 who leave an estate that exceeds that amount, it will be subject to federal estate taxes of up to 40% of the amount over the threshold.

If the TCJA sunsets, this exemption will be reduced back to a base of $5 million, adjusted for inflation. What this means is that without proper planning, there is a much higher chance that exceeding the Federal Estate Tax Exemption could come into play for you and your family. While this may not be relevant today for your own estate, remember that this is calculated and applied upon your death. After a lifetime of saving and investing, the estates of many more people may land above the threshold. (Please note: many states with estate taxes have their own exemption amounts, which are often much lower than the federal amount.)

We recommend that you speak with your estate planning attorney with any concerns you may have. You may want to reassess your current trust and/or will considering these potential changes.

We’ll keep you informed about impacts of the TCJA sunset—and adjustments

We’ll continue to monitor the potential sunsetting of the Tax Cuts and Jobs Act over the next year. The extent to which we think each client could be impacted will vary: Every individual and family’s income and tax deductions are unique. We’ll keep working to stay ahead of the changes and make adjustments as tax code modifications are confirmed.

And of course, we’ll continue to keep an open line of communication with you and your CPAs and estate planning attorneys to evaluate financial planning strategies that can help you position yourself to best meet these upcoming challenges.

Disclosures:

Halbert Hargrove Global Advisors, LLC (“HH”) is an SEC registered investment adviser located in Long Beach, California. Registration does not imply a certain level of skill or training. Additional information about HH, including our registration status, fees, and services can be found at www.halberthargrove.com. This blog is provided for informational purposes only and should not be construed as personalized investment advice. It should not be construed as a solicitation to offer personal securities transactions or provide personalized investment advice. The information provided does not constitute any legal, tax or accounting advice. We recommend that you seek the advice of a qualified attorney and accountant. All opinions or views reflect the judgment of the author as of the publication date and are subject to change without notice. All information presented herein is considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted.