By Nick Strain, CFP®, CPWA®, AIF®, Senior Wealth Advisor

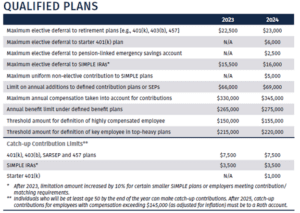

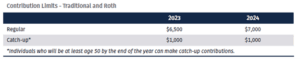

Increases from last year in the amounts you can contribute into retirement plans and IRAs/Roths mean greater tax deferrals and more retirement savings.

To get started on taking advantage of these increases, please check your 2023 qualified retirement plan statements to confirm your 2023 contribution.

You can then determine how much will be needed to adjust your contribution rate to max out your contribution for 2024.

If you are 50 years old or more and want to make a “catch-up” contribution, be sure to reach out to your retirement plan administrator to confirm how you’d like to make this additional contribution.

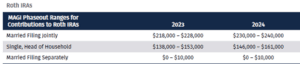

Here are the IRS’s contribution limits for 2023 and 2024:

Please contact your team if you’d like us to estimate your “MAGI” – Modified Adjusted Gross Income using your previous year’s tax return and 2023 W-2s. That goes for any questions you may have about tax-related changes you’re contemplating.

We’re ready to help.

Contact Us Now to Discuss your Retirement

Disclaimer:

Halbert Hargrove Global Advisors, LLC (“HH”) is an SEC registered investment adviser located in Long Beach, California. Registration does not imply a certain level of skill or training. Additional information about HH, including our registration status, fees, and services can be found at www.halberthargrove.com. This blog is provided for informational purposes only and should not be construed as personalized investment advice.

It should not be construed as a solicitation to offer personal securities transactions or provide personalized investment advice.

The information provided does not constitute any legal, tax or accounting advice. We recommend that you seek the advice of a qualified attorney and accountant.