by Paul Eitelman – Russell Investments

Is the current rout in markets the beginning of an extended pullback?

Shaken by fears of an expanding coronavirus outbreak, financial markets—which already came under pressure late last week—sold off aggressively in Monday’s trading session, with the Dow Jones Industrial Average plunging over 1,000 points. The S&P 500® Index tumbled 3.4% by Monday’s close, while the yield on the benchmark 10-year U.S. Treasury note neared an all-time of low of 1.356%. As of Tuesday morning Pacific time, the selloff was continuing, with most major benchmarks down another 1%.

What’s sparking the selloff? Reports in recent days of new outbreaks in Beijing, Italy, South Korea and Iran have investors worried about a deeper and more durable threat to the global economy. And these fears are not unfounded.

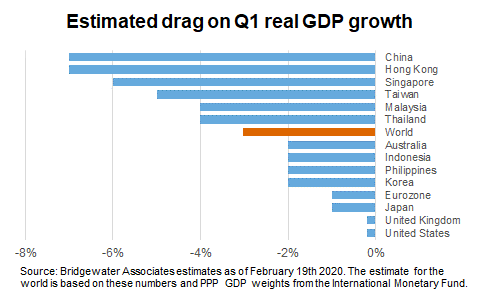

Click image to expand

It goes without saying that pandemics pose a downside risk to the global business cycle. Quite simply, they disrupt economic activity and corporate profits through a number of channels. For example:

- Containment efforts – Closed factories means no output is produced.

- Supply chains – The reliance on an impacted area, such as the Wuhan region of China, for intermediate inputs can delay deliveries.

- Tourism – Travel controls and fear can slow dependent service industries.

- Spending – Consumers may defer discretionary purchases by avoiding busy retail centers.

It’s clear from the high frequency data coming out of China that we are on track for a rather large hit to economic growth in the first quarter of 2020. These economic impacts should be felt the strongest in China (the epicenter), emerging Asia, Japan, Europe, and—to a lesser degree—the United States.

Click chart to expand

If there’s anything of a silver lining to the dent in global GDP (gross domestic product) the virus is expected to cause, it’s that history suggests that, if/when this virus is ultimately contained, we should expect to see a rapid normalization in economic growth rates and corporate fundamentals.

The virus: Know what you don’t know

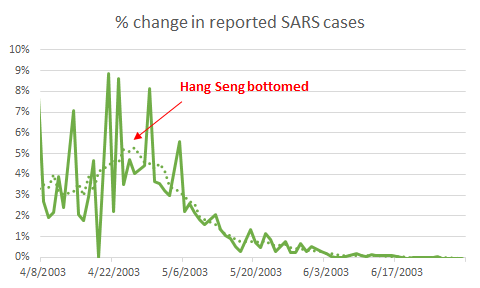

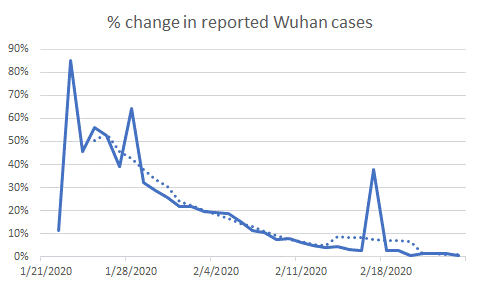

We do not claim to have any unique insights or edge on forecasting the severity or duration of the current coronavirus outbreak. What we do know, however, is that based on previous episodes (e.g., SARS in 2003), equities should likely find a bottom once it can be credibly determined that the virus has been contained. Put differently, markets will likely recover when investors think the impulse of new coronavirus cases has peaked.

Click charts to expand

Source: World Health Organization data, as of Feb. 24, 2020.

Markets through the middle of last week had largely looked through the coronavirus as a transitory risk factor—indeed, the impulse of new cases was moderating very nicely (see chart above). However, with several new centers of disease in populated, economically important areas, this view has been challenged.

Key watchpoints for markets

In the days and weeks ahead, markets will be focused on three key things:

- 1. The duration and breadth of the epidemic – If it accelerates into April and drags down Q2 data or spreads more prominently to other countries.

- 2. Non-linearities – If companies fail, creating negative ripple effects (e.g., the closure of Chinese movie theaters). Given the interrelated nature of global supply chains, this is a risk we are closely watching.

- 3. Policy response – If fiscal and monetary authorities step in with ample liquidity to prevent the above.

Global market outlook: Mini-cycle delayed, not derailed

The phase 1 China-U.S. trade deal and three U.S. Federal Reserve (the Fed) rate cuts in 2019 had seemingly set the stage for a reacceleration in global economic and earnings fundamentals this year—a positive mini-cycle in the eleventh year of the global expansion. The coronavirus is clearly a setback to this outlook. Based on what we know now, it appears to have delayed the mini-cycle thesis until at least the second quarter of 2020.

However, there is some good news. With inflationary pressures currently muted around the world, there’s a very low bar for central banks to inject liquidity and smooth the experience around the coronavirus. We’ve already seen easing measures announced this year from China, Hong Kong, Singapore, Taiwan, Thailand, Malaysia and the Philippines.

The Fed—while on hold for the time being—may cut interest rates, too, if the virus impacts turn out to be larger and more durable than initially anticipated. On the fiscal policy side, we have already seen measures being announced in a number of Asian economies, including China, Hong Kong, Singapore and Taiwan.

In fact, similar to what we ultimately found with the trade war, the virus could turn out to be a cycle-extending deflationary shock if it delays the date at which the Fed is willing to take the punch bowl away.

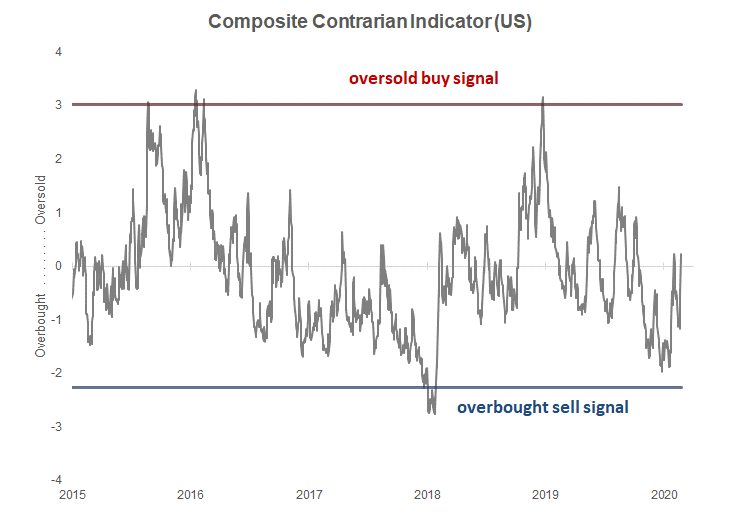

Investment strategy: Looking for evidence of a panic

We ultimately view COVID-19 as an unforecastable downside risk to the global business cycle. Yet we aren’t changing our investment strategy on the whims of the daily news cycle. We believe much of this repricing in markets is appropriate.

Most of the time, financial markets are reasonably efficient pricing vehicles. But at certain moments, the collective market psychology can swing to an unsustainable extreme of panic or euphoria. Our proprietary blend of technical, survey and positioning data does not suggest that global market sentiment has reached an extreme of panic yet. But directionally, we would look for an opportunity to buy a more significant dip in global equities here.

Click chart to expand

Source: Russell Investments. Data as of Feb. 24, 2020.

Recent days have emphasized all-too well the important role that a well-constructed and well-diversified multi asset portfolio can play to help investors still meet their objectives while weathering unforecastable events like this virus. Remember that a multi-asset portfolio was built specifically to withstand market turbulence, and that fairer skies are likely ahead.

For more information or questions, please contact Halbert Hargrove at hhteam@halberthargrove.com